As a rental business owner, you want to get your equipment back in one piece every time. Equipment rental customers expect to rent machinery that is in good, safe working condition.

Unfortunately, the parties involved can’t just rely on the honor system when it comes to such expensive machines. A clear, comprehensive equipment rental liability waiver protects you and your customers by outlining the responsibilities and obligations of both parties.

need an airtight liability waiver? click to download our free template* This is a sample liability waiver form. Please consult with a lawyer before use.

Liability and Equipment Rental Businesses: How to Protect Yourself Legally

A liability waiver for rental equipment details how equipment should be used, who is allowed to use the equipment, and in what ways you, the rental business owner, will be responsible in case of an injury during the use of the equipment.

Accidents can happen even with proper use by the client and proper maintenance by you. If you don’t provide a well-written waiver with your rentals, you may be liable for any damages caused.

Note that even the most comprehensive waiver does not take the place of insurance. You may still face a lawsuit despite having a liability agreement. Make sure that you have plenty of general liability insurance to fill in the gaps not covered by your agreements.

Your waiver needs to be legally enforceable, but it will still only reduce your chances of getting sued or facing insurance claims.

What Is a Liability Waiver?

A liability waiver is a legally binding document that outlines all of the stipulations for allowing one person to rent a piece of equipment from another. More specifically, the waiver outlines:

- The parties involved in the rental (the lessor and the lessee)

- The appropriate use of the equipment

- The timeline of the rental

- The rates of the rental

- How to return the equipment

When the customer signs the waiver, it shows that they are fully aware of the risks of using the equipment and can’t hold you or your company responsible should they misuse it.

As for terms that may be included in your waiver, you may have noticed “lessor and lessee” listed above. These terms refer to the two main parties:

- Lessor: Refers to you, the owner

- Lessee: Refers to the customer renting the equipment

You don’t have to use these terms specifically and can instead use “owner” and “renter” if you prefer. The more clarity and details you give your waiver, the less likely you’ll experience legal difficulty in the future.

Brush up on equipment rental agreement terms and conditions with our guide.

What to Include in an Equipment Rental Liability Waiver

While there are some universal inclusions your waiver should have, there will be subtle differences depending on which state you operate from. You will need to consult with a lawyer or thoroughly examine state law to ensure you are in compliance.

Inherent Risks

This part of the waiver does not cover the condition or state of repair your equipment exists in; instead, it covers proper use of the equipment and the risks it poses regardless of condition. Every machine comes with some risk by its very nature, and the possible risks must be outlined here.

Assumption of Risk

Your customers will not be able to claim ignorance of the risks posed by using your equipment. The assumption of risk shows that they understood the dangers and cannot claim otherwise.

Release Clause

Once your customer takes possession of your equipment, you are released from any liability for its use and won’t carry the legal burden should the customer misuse it.

Indemnification Clause

This means that your customer would have to compensate you for legal fees incurred should they sue you and lose.

Insurance Information

This gives the customer all of the situations covered by your equipment rental insurance, outlining what is covered and what isn’t covered.

Choice-of-Law Information

This part of your rental equipment liability waiver allows those involved to decide which state’s laws will govern and interpret the waiver. The parties may choose a state other than where the business and customer are located and even a different state than the one in which the agreement was signed.

Insurance for Rental Equipment: Making Sure Your Business is Fully Protected

Unfortunately, “insurance” isn’t a catch-all term that allows you to get a single policy to cover every possible situation. Instead, you’ll need different types of insurance to cover specific incidents. It’s important to remember that even with specified insurance, it is still possible to face a lawsuit or insurance claim; it’s just far less likely to happen.

General Liability Coverage

This type of coverage protects you in most circumstances that involve customers using your equipment. It covers general claims regarding injuries and property damage. The payout is determined between the insurance company and the client.

Inland Marine Insurance

While this might sound like it’s for equipment used in and around the water, it’s instead meant to cover the transport of equipment over land. It covers property damage (both to your equipment and from your equipment), theft during transport, and temporary third-party storage.

For coverage regarding transport over water, a company would need to purchase “marine insurance.”

Property Insurance

Property insurance covers the equipment and tools in case of damage or theft. This insurance is important not just for the equipment you rent out but for your company’s computers and other necessary electronics, inventory, and tools not intended for customer use.

Workers’ Compensation Insurance

This insurance takes care of workers who are injured during work. It allows them to continue having expenses handled and salary paid.

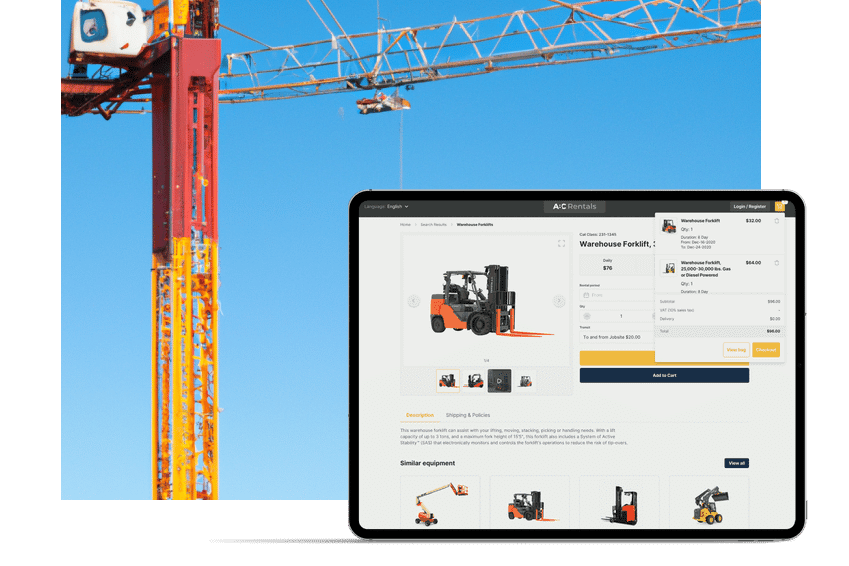

Reduce Your Rental Business’s Risk with Quipli

Managing rentals, inventory, and equipment reservations requires keeping track of many moving parts. To ensure your equipment, tools, and even your customers don’t get lost in the shuffle, turn to Quipli for your equipment rental software.

Check out what Quipli can do for you and transform your rental business today.

Learn About Quipli’s rental Software