u’ll need to spend on equipment? Using an equipment loan calculator can help you find out exactly what you can afford.

Construction equipment can be expensive, and you’re likely to need business loans to purchase it.

A good equipment payment calculator will allow you to customize all aspects of your loan — helping you figure out exactly what works for you.

Many banks offer equipment financing, and some financing companies specialize in loans for construction and heavy equipment. Before contacting a lender, you can use an equipment finance calculator to get an idea of what to expect.

The key inputs for a heavy equipment loan calculator are similar to those for many loans — the amount financed, the interest rate, and the loan length (also known as the loan term). However, there are some nuances specific to the equipment financing industry that you should know about.

Free Online Construction Equipment Loan Calculator

Here’s a free online equipment finance calculator that can help you see how your payment will change based on the various inputs you choose, such as interest rates and loan terms:

Tired of juggling spreadsheets and calculators? Click here to book your demo with quipli !

How Equipment Loan Payments Are Usually Determined

Three key inputs will largely determine your loan payment:

-

The amount you’re financing

-

Your interest rate

-

The loan term

When using an equipment loan payment calculator, you’ll find that the more money you finance, the higher your payments will be. This reality is true for interest rates as well — the higher the rate, the higher the payment.

However, the payment amount will go down if you increase the loan term (although you’ll likely pay more interest over the life of the loan).

Let’s look at the three key elements in more detail:

1. Equipment Loan Total Amount

The loan amount will be the amount you’re financing, which is generally the total purchase price of the equipment, less any down payment you make.

Equipment costs in your industry will largely determine the amount you need to finance. Other factors that will determine the amount you can borrow include the lifetime value of the equipment and whether it’s new or used.

Some equipment loans are for $5,000 or less, while some lenders have minimums on the amount they’re willing to lend for equipment loans, such as $10,000 or $25,000. Typically, the lower the amount you’re financing, the higher the interest rate. If you are financing $5,000, the rate will tend to be higher than if you’re financing $50,000.

2. Interest Rates

Interest rates will vary based on the industry and equipment you’re financing. They can be anywhere from 2% to 20%. If you’re required to provide a personal guarantee, your credit score will also play a part in determining the interest rate.

Other factors that play a part in the interest rate calculation are your company’s financials, such as annual revenue and length of time in business. The type of equipment and its lifetime value will play a role in the interest rate as well.

Resale value is also a consideration. If the equipment holds its value well, you may be able to get a lower rate. The lender might see the loan as less risky when compared to one for equipment that depreciates quickly.

3. Loan Terms

The loan term is the length of time of your loan. This duration for equipment loans tends to be between two and seven years. Some lenders may have a cap of five or ten years on the terms they’re willing to offer for equipment loans.

Generally, the longer the loan term, the higher the interest rate tends to be. Thus, if you’re financing a piece of equipment for two years, the rate should be lower than if you selected a loan term of seven years.

Note that you can often pay the loan off early or make additional payments to shorten the loan term (and save interest). However, some financing companies may charge a prepayment penalty if you decide to pay off the loan early. Make sure to factor that cost against any interest savings when you’re considering paying early.

What You Should Know About Equipment Financing

Even the best equipment financing calculator won’t be able to account for your specific situation or the special requirements that a lender might have.

Minimum Requirements

Equipment lenders may have minimum requirements for your business, such as thresholds for annual revenue and length of time in business. For example, a lender may require that you have at least $25,000 in annual revenue and have been in business for at least six months before considering you for a loan.

Other key requirements include minimum credit scores and required down payment amounts, which may vary between 5% and 20%. Also, recall that some lenders may have a cap on the loan term, such as 48 months, and minimum loan amounts, such as $25,000.

Special Requirements

Some lenders will also allow for special repayment schedules, such as weekly or bi-weekly payments instead of monthly ones. They may also specify a balloon payment that’s due every 12 months or at the end of the loan’s term.

Other things to watch out for when using a construction loan calculator include upfront charges by lenders, such as origination and application fees. Don’t forget to ask about prepayment penalties or potential discounts for early payoffs.

Examples of Typical Loan Payments for Construction Equipment

So what do the numbers generally tend to look like? Here are a few examples, based on the average cost of common types of heavy construction equipment, based on our calculator.

These numbers assume a 36-month loan repayment period, an interest rate of 7.5%. Total loan amounts are based on the mean average cost for each type of equipment.

(For more information on typical prices for heavy equipment, check out our post on Construction Equipment Prices in 2022.)

- Excavators: $9,331.87

- Backhoes:$1,477.55

- Bulldozers: $3,888.28

- Skid steer loaders: $1,010.95

- Wheel loaders: $4,665.93

- Concrete mixer trucks: $3,888.28

- Motor graders: $7,776.55

- Forklifts: $1,088.72

- Bucket trucks: $2,752.90

Prices can vary significantly, but these numbers can give you an idea of around how much you can probably expect to spend each month. Need more help on pricing? Explore our how to value a rental business guide.

Financing Equipment for Your Equipment Rental Business?

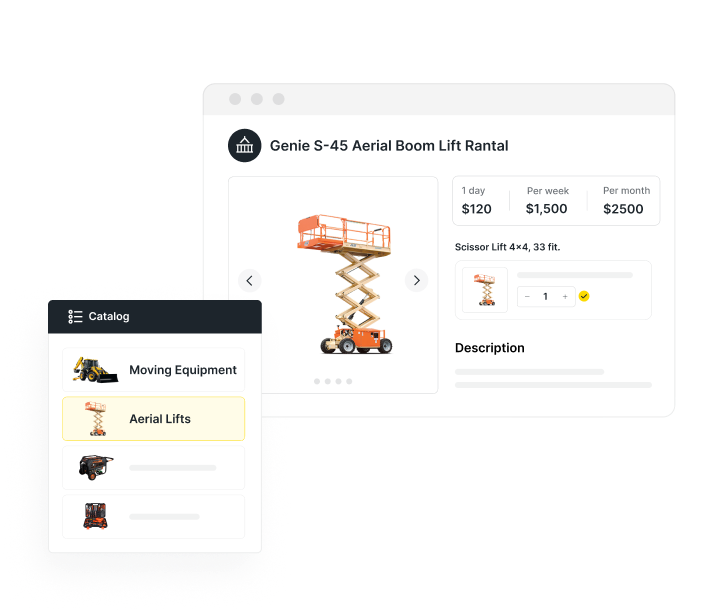

If you’re looking to add new equipment to your rental business and increase your profit, Quipli can help. Quipli’s rental eCommerce platform helps manage your inventory and website to make it easier for customers to find what they need.

Our all-in-one software also makes it easy for you to manage your invoices and orders. You can find out how Quipli makes the sales and inventory management processes easy by booking a 15-minute demo.

Starting a new rental business? Refresh on the basics with how to start equipment rental business.