The construction equipment rental market is expected to continue growing despite economic uncertainty.

Currently, the industry does face challenges like higher raw material prices, rising interest rates, and an overall lack of skilled workers. This uncertainty has proven to be a net positive for equipment rental companies and the growth of demand for rental construction equipment.

The rising cost of purchasing equipment will also push even more construction companies to consider renting.

Renting allows contractors to take advantage of the latest construction equipment technology without the high cost of ownership.

Tech-focused machines that help improve efficiency for construction companies are expected to be a hot market for rentals, helping drive industry growth for the next several years.

The Equipment Rental Industry Is Continuing to Grow

Strong growth is expected regardless of which equipment rental industry statistics you look at.

For example, data published by the American Rental Association (ARA) shows the total revenue for the equipment rental industry (which includes construction/industrial and general tool rentals) is expected to hit $52.3 billion in 2022, growing by almost 10% from 2021.

The ARA also projects 5.5% growth in 2023, 2.5% in 2024, and 3.3% in 2025.

Meanwhile, Market Data Centre (MDC) research shows that the total value of the construction equipment rental industry was $108.1 billion in 2021. MDC projects the industry to grow to $156.8 billion by 2030.

From 2022 to 2027, MDC expects the industry to grow at a compound annual rate of 5.46%.

Construction Equipment Rental Industry Statistics

According to research by Grand View Research, the size of the construction equipment rental market grew to $73.44 billion in 2021. That number is expected to grow by 3.9% annually through 2030 — hitting $105.29 billion in 2030.

This growth comes despite inflationary concerns and supply chain issues that have carried over since the pandemic. The uncertainty has led many contractors to delay major purchases in favor of renting. This tactic also allows such companies to decrease

The capital needed to start new projects.

Construction contractors are also opting to rent equipment to help offset the rising prices of new equipment. More efficient machines, thanks to tech advancements, bring higher prices as well — another reason for the expected growth in the rental market.

Earthmoving Equipment Has Had Significant Recent Growth

Fast growth in the earthmoving equipment segment has been a key construction equipment trend in recent years. It accounted for 50% of the market share for construction equipment rentals in 2021 and was responsible for over half of the industry’s growth.

This segment of equipment rentals includes machines such as skid-steers, excavators, and backhoes. The increased use of such machines in mining and agriculture industries is driving the earthmoving equipment rental market.

Bigger projects require more earthmoving machines. That’s in addition to continued growth in the residential and commercial construction industries.

Learn more about the most expensive construction equipment as well as the most popular equipment to rent.

Material Handling Machinery

Material handling machinery equipment rental industry revenues are expected to grow at a compound annual rate of 4% through 2030. The demand for crawler cranes is driving this industry, with increased demand for material handling machines used in manufacturing and industrial construction.

Again, bigger projects around the globe have increased the demand for material handling machines.

Concrete and Road Construction Machinery

The concrete and road construction equipment segment is expected to see some of the best growth over the next decade, with a compound annual growth rate of 6.5% from 2022 to 2030. Total value of the industry is expected to hit $39.1 billion by 2030.

This industry will be one of the biggest benefactors of increased road construction in the United States, as well as the increased adoption of road connectivity. Improved road infrastructure that promotes safety and causes fewer automobile fatalities will likely be a priority for federal spending.

Key Growth Drivers for the Construction Equipment Rental Market

Beyond the economic uncertainty and rising costs of construction equipment that will lead to more construction companies renting equipment versus buying, there are other growth drivers for the industry:

Infrastructure Spending

These key growth drivers include the Infrastructure Investment and Jobs Act (IIJA), which will boost federal spending on infrastructure. As well, the push toward net zero emissions by utility and energy companies will further drive construction in those areas.

The IIJA will include an investment of $110 billion in infrastructure improvements in the U.S. This includes spending on roads and bridges — notably improved road connectivity that will help improve commerce and trade. Increased road connectivity will also promote safer streets.

Technology

Construction equipment fitted with the latest technology will be a key demand product for contractors. However, the high cost of these technology systems prohibits many smaller builders from being able to purchase them outright. Thus, rental opportunities for equipment that has new systems installed will be in high demand going forward.

Such technology can improve the efficiency of construction projects and help cut costs. For example, a technology-enabled piece of equipment can relay key data to owners, such as GPS information, fuel consumption, and equipment idle time.

With these benefits come big costs, making some solutions too expensive for many contractors — hence the increase in demand for rentals.

Growing Benefits

In addition to allowing builders and contractors access to equipment equipped with modern technology and easing the total cost of ownership, the roster of benefits provided by rental companies continues to grow.

Rental companies are providing additional services to better serve customers, such as onsite support and greater investments in repairs and maintenance. These benefits come in addition to savings on inventory costs and initial cash outlays.

Thinking About Getting into the Rental Market?

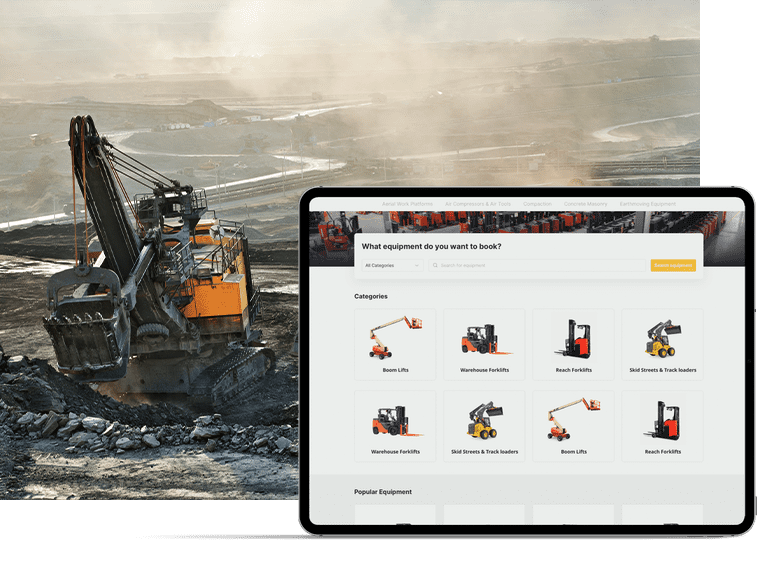

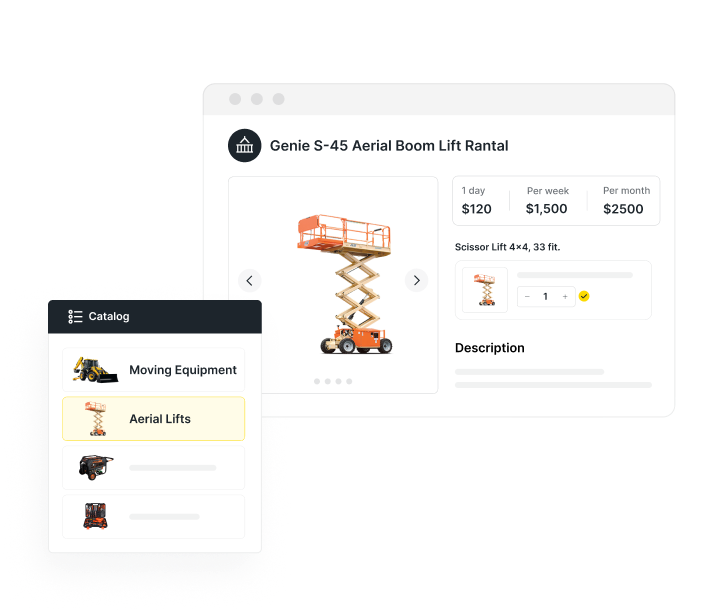

Quipli makes renting equipment easy for customers while making it simple to run an equipment rental business. Inventory management is presented in an easy-to-follow way with Quipli’s eCommerce platform. When it comes to managing orders and invoices, Quipli makes those tasks easy as well.

Explore additional construction equipment rental business ideas to help solidify your construction equipment rental business plan with Quipli.

It’s all done right on the platform, making it an all-in-one tool. Utilize Quipli’s rental website builder to grow your business and find out more about how we can help your rental business by booking a Quipli demo.

Learn About Quipli’s Contruction Equipment rental Software