Equipment rental insurance is a form of insurance that you can get if you rent out equipment to customers. It’s instrumental in helping avoid costly losses and downtime for your rental business.

Equipment coverage can insure large pieces, such as excavators, as well as the tools and inventory you rent out, such as post-hole diggers.

What Is Rental Equipment Insurance?

Insurance for rental equipment covers the items you rent out, such as tools, equipment, and other inventory. Rental business insurance can be bought to cover any kind of equipment.

Having rental equipment insurance coverage will protect you in case something happens to your equipment, such as theft or a major accident. There are also other options for your business that’ll cover you beyond just lost equipment.

When it comes to rental equipment insurance, you’ll also have policy specifics depending on the equipment you rent out. If you offer heavy equipment, your insurance policy may assume that you’re renting to individuals or companies that are insured and licensed.

There may also be limits on how long you can rent out equipment, as the longer the rental period, the greater the likelihood of damage or loss. You can help protect yourself with proper insurance coverage and the rental contract you use, which can stipulate renters liability insurance for your customers.

Types of Rental Insurance

Equipment rental business insurance is available for various types of equipment. There are different coverage options and plans based on the equipment you rent out.

Naturally, rental insurance will vary by business. For instance, insurance types and coverage options will be different for a party rental business than for a golf cart rental business. Heavy equipment rental insurance will have different options as well.

Here are some key types of insurance for equipment rentals that you’ll likely encounter on the market.

Floater Coverage

Also known as inland marine coverage, floater coverage is a type of add-on coverage that covers rental properties not covered by other policies. This includes property you rent from others as well as newly acquired rental equipment.

Commercial Property Coverage

Commercial property coverage is a broad category of insurance that, in some cases, covers the things you own and use as part of your business along with your company’s physical premises and related real estate. This could include office furniture, computers, and non-rented equipment and appliances.

Commercial property coverage covers rental businesses in the event of damage or loss, such as employee theft.

Commercial Auto Coverage

Commercial auto coverage is for the vehicles you own and use as part of your business, such as delivery vehicles. This will cover vehicles you rent, lease, borrow, or own.

Umbrella Coverage

Umbrella and excess coverage will protect you if a claim goes beyond its limits. For example, if you have a major liability claim from a lawsuit, umbrella coverage will kick in if the claim exceeds the limits of the primary general liability policy.

Other Coverage Options

There are also other specialized insurance services offered to rental businesses, such as business income coverage. Business income coverage covers lost income if the business can’t conduct business due to a covered event.

For example, business income coverage for off-premises utility services will replace business income if they can’t conduct business due to unexpected utility interruptions.

Another common example is property-in-transit coverage, which will cover your rental property if it’s damaged during shipment.

What Does a Basic Equipment Insurance Policy Cover?

There are two main types of rental equipment insurance coverage: covered property and replacement cost. Covered property covers anything you rent out, while replacement cost coverage is for equipment that must be replaced.

Good basic equipment insurance should include broad coverage, protecting such things as lost or stolen equipment, equipment damaged due to misuse or weather, and cleanup for covered incidents.

Covered Property

Covered property is coverage for pretty much anything you rent out. For example, covered property coverage would cover flatware, serving utensils, and party supplies for a wedding rental company.

Other items that would fall under the heading of covered property include wood chippers for a lawn equipment rental business and video recording equipment for a media rental company.

Replacement Cost

Replacement cost coverage is for equipment that becomes irreparably damaged or lost. Replacing such equipment can be costly. This coverage can ease the financial burden by providing some or all of the money required for replacement.

General Liability Insurance for Equipment Rental Businesses

Insurance for equipment rental generally includes covered property and replacement cost coverage, but you’ll also need general liability insurance to protect you beyond rental-specific issues. General liability coverage will protect you from lawsuits customers file against you.

Lawsuits can arise for a variety of reasons. For example, a client that’s injured while using equipment they rented from you may file a lawsuit to cover their injuries and distress. Similarly, a property owner might sue you if a piece of equipment you rented out to them accidentally destroys a building. General liability insurance can help protect your business from having to use valuable resources to fight such lawsuits.

General liability coverage can protect your business against lawsuits, damages, and lost equipment. But it can also protect against negligence, slander, errors and omissions, and contractual liability.

The risks of owning a rental equipment business are unique and diverse, but good insurance can greatly hedge many of them. As mentioned, a good rental contract can also protect your business from loss.

It helps to know what your insurance covers and what it doesn’t.

For example, what happens if a customer simply doesn’t return the equipment they rented? What happens if they lend out the equipment to someone else and that person damages your equipment or injures someone? These are the kinds of questions you’ll want to think through and address with your insurance agent.

Make Rentals Easy With the Right Partner

The less you have to worry about as an equipment rental business owner, the better. Proper insurance coverage can ease your mind regarding what might happen to your equipment when it’s in customers’ hands.

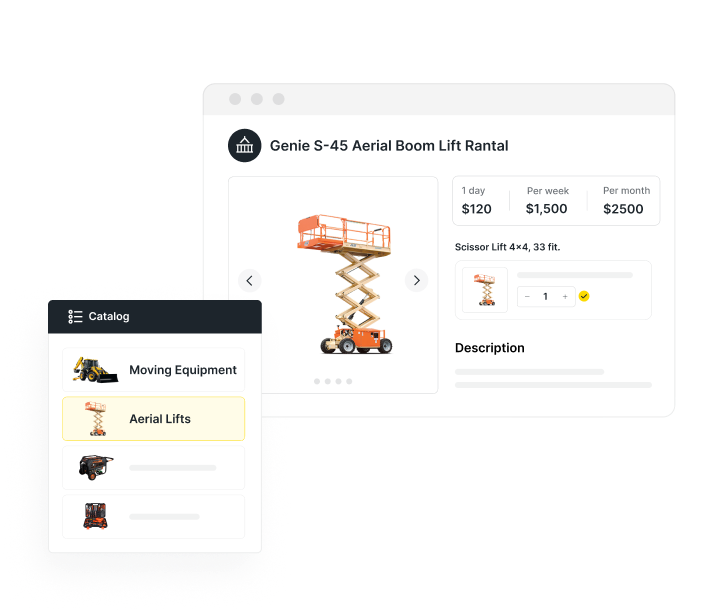

Another way to reduce your business-related stress is a proper rental inventory management system. Quipli offers a platform that does the hard work of managing your rental inventory for you. Contact us today to get a demo.

Need help evaluating your equipment value? Here are two handy guides: New and used equipment values and how to value a rental business.

Learn About Quipli’s rental Software