Key performance indicators (KPIs) are an essential part of any business in any industry, and equipment rental is no exception.

In the spirit of the old adage “what gets measured gets managed,” you first need to know exactly what you want to measure, and why those specific KPIs are the most impactful. Is it driving revenue? Customer happiness? Retaining customers and expanding with them? Winning new ones? Managing cash flow and optimizing asset utilization?

So here’s the scoop on KPIs – how they work, what your options are, and which ones you need to be tracking if you’re in the equipment rental business.

Table of Contents

- What is a KPI, and How Is It Used?

- What Makes a Good KPI?

- The 3 Key Types of KPI for Equipment Rental

- What are the Top 5 KPIs for an Equipment Rental Business?

- What Are the Top 5 Financial KPIs in Any Rental Business?

- What are the Top 5 KPIs for Sales and Marketing in an Equipment Rental Business?

- What are the Top 5 KPIs for Customer Satisfaction for Rental Equipment?

- Construction Equipment Rental KPIs

- What Software Tools Should I Use to Manage KPIs?

A Quick Refresher: What Is a KPI, and How Is It Used?

The fundamental principle underlying key performance indicators (KPIs) is that you need something measurable. You can’t estimate or just feel things out in the world of business.You need to know what works and what doesn’t if you’re going to succeed.

KPIs are the specific data points you’re using to measure your success. While revenue is a huge part of it, there are other things along the way that you also need to measure to make sure you’re able to make that revenue.

In equipment rental, margins can become tight, and breaking even on equipment is important. It’s a unique industry with unique needs.

Whether you’re looking into equipment rental KPIs, regardless of the equipment type, the common factor is that the factors that they represent are going to be solid and measurable.

So what makes for a good KPI, one that’s worth measuring?

The right KPIs will have certain characteristics:

- Owned. People in your equipment rental company need to be responsible for overseeing, measuring, and refining KPIs. It needs to be obvious who to talk to if you need something relevant to them.

- Understandable. Everyone working at your equipment rental company needs to understand what KPIs you’re using, and how they’re measured.

- Actionable. You need your folks to know what to do to influence your KPIs. It needs to be something you can take action on.

- Measurable. This is a big one. It has to be something you can directly measure and quantify. It can’t be something soft and vague.

- Leading. Good KPIs help you predict and enhance how well your business does in the future.

- Timely. You need to make sure you can keep the data for every KPI consistently up to date. (Our software is designed to help you do this.)

- Strategic. KPIs need to be tied to something very important – your vision for your equipment rental business. How do you want to grow? Where do you want to be in five years? Do you want to expand your fleet? To grow and hire more employees? To make more money?

These are the most important aspects that, for your business, will help you figure out the right KPIs. A good KPI should meet these criteria.

KPIs aren’t just about where your company is right now. They’re about where you want to go.

The Three Key Types of KPI for Equipment Rental

There are three subtypes of KPI that are important for you to track:

- Core business KPIs

- Sales and marketing KPIs

- Customer satisfaction KPIs

All of these are important for making sure your equipment rental business is successful. We’re going to break these core KPIs down category by category.

What are the Top 5 KPIs for an Equipment Rental Business?

The nature of a rental business model brings its own unique challenges. You have to manage things like availability and booking, not just inventory alone. Margins can become strained if you’re pricing your equipment wrong, or struggling to track your equipment.

Because equipment rental has these specific elements involved, you need to measure different things than a company that outright sells its product, or a business that offers a service rather than a product per se.

Here are the top KPIs that tend to bring the best results in the world of equipment rental:

- Return on Investment

- Net Profit

- Time to Break Even

- Stock to Rental Ratio

- Income to Maintenance Ratio

Now, there are also other KPIs to track, which are more geared towards your sales and marketing efforts. You’ll read about those a bit further down.

The five above are the most important ones for your core business operations.

Whether you’re renting out heavy construction equipment or general tools and light equipment,, these are the ones that really matter.

Here’s a rundown of each of these KPIs – what they mean and why they matter.

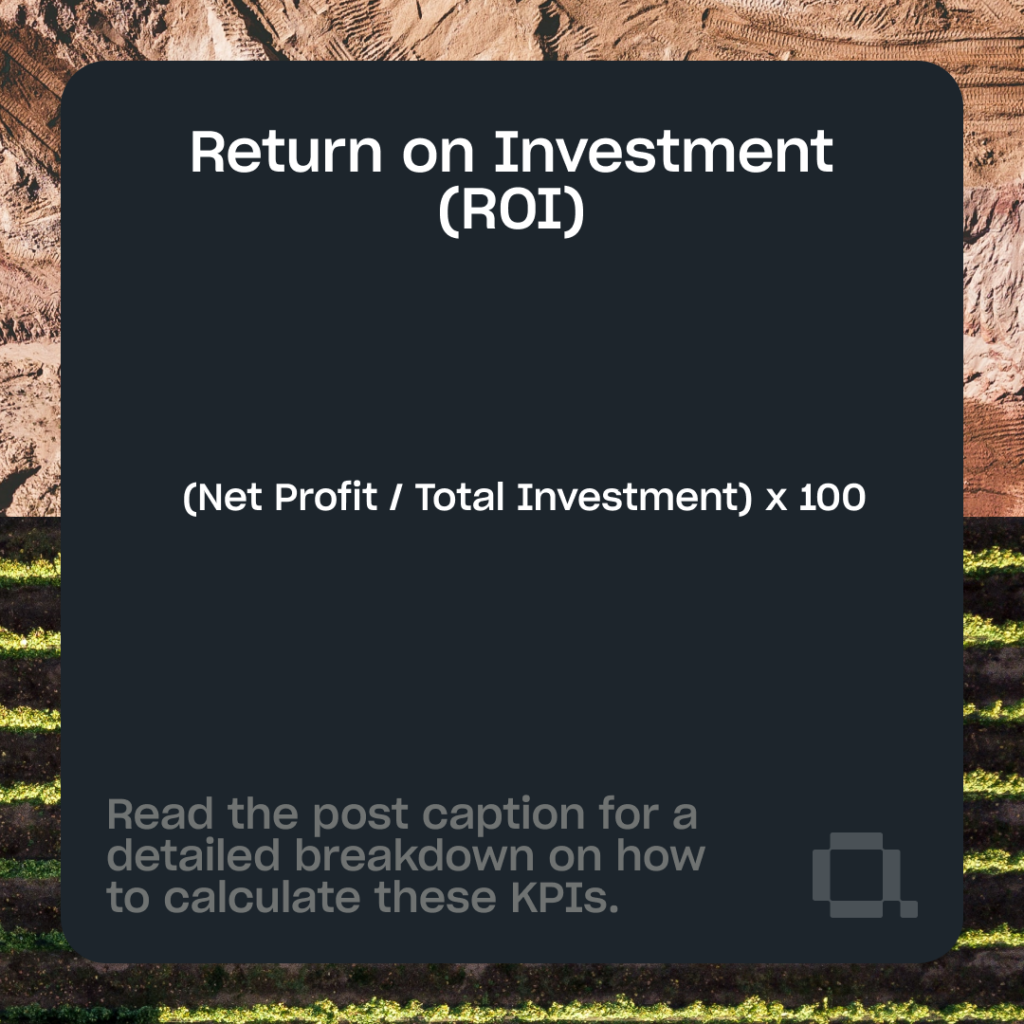

Return on Investment

Return on investment (ROI) is a KPI that sees use across pretty much any industry, including yours. Why? Because it’s important. Indispensably so.

ROI is pretty simple: it’s the profit from your investment divided by the input costs. It demonstrates how much money you’ve made compared to how much you’ve spent.

This tends to be the primary KPI for just about any kind of business.

So how do you guarantee a good ROI in the rental industry? One major way you can do this is by focusing your fleet on high ROI equipment.

If you’re getting a low ROI on a piece of equipment, it can mean one of two things:

- You’re not charging enough for people to rent it, and you need to raise the price.

- The market is saturated, driving down the prices.

Market saturation can happen with all kinds of different equipment. It’s too widely available, with too many people offering it, and the high competition drives down the price. This means it takes too long to break even on the cost of the machine.

Look at ROI on each type of equipment you’re renting out. Look at what the market landscape might be like. If an item has a consistently low ROI, it might be time to discontinue offering it, and focus on the items in your fleet or inventory that are actually making you money.

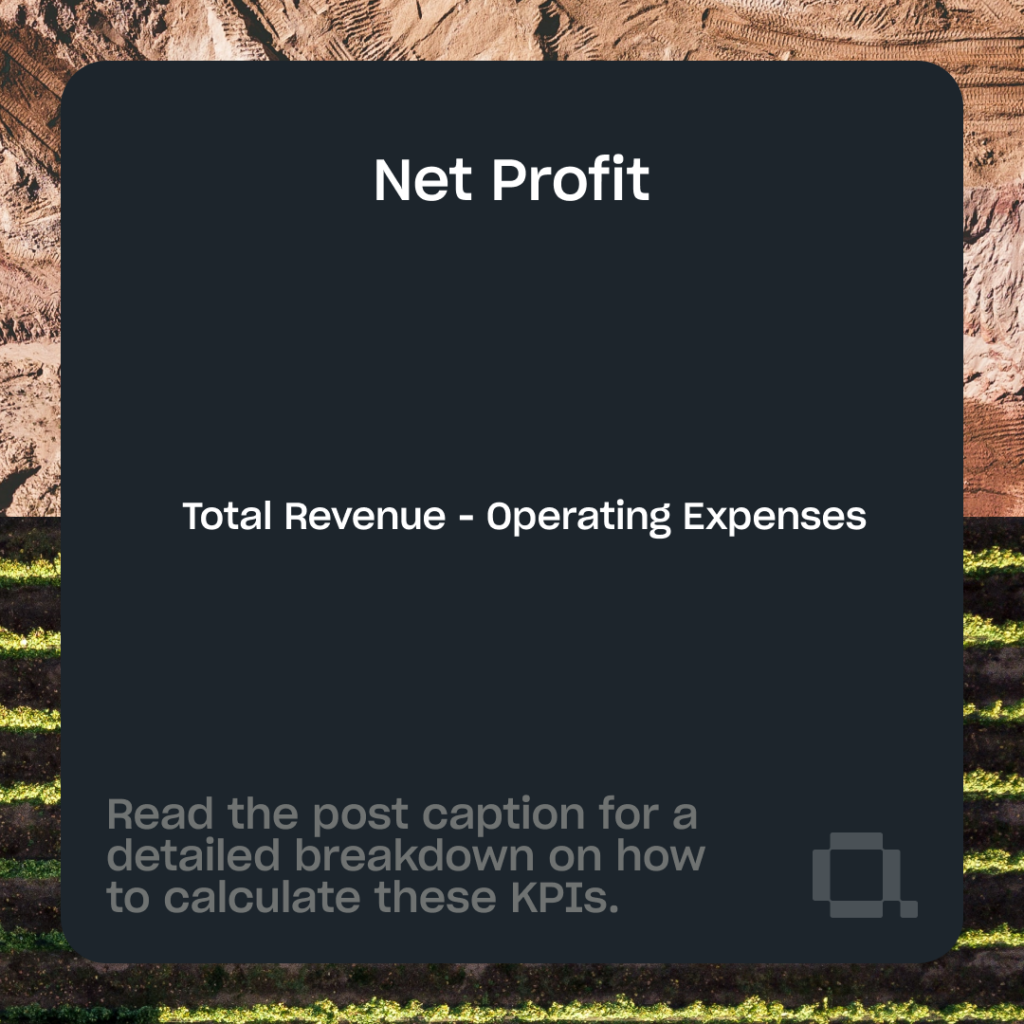

Net Profit

“Profit is its own reward.” – the Ferengi aliens from Star Trek.

Optimizing your cash flow and profit leads to long term viability and success. This is as true for equipment rental as it is for traditional retail, a restaurant, or a law practice.

Time to Break Even

How long is it taking you to break even on the cost of a piece of equipment you bought?

How many times do you need to rent it, and at what price, for you to make your money back on what you spent to buy it?

If you’re not pricing your equipment right, or you’re buying at too high a price, you may need to reassess how you’re investing in that equipment, and what the market for it looks like.

One way to reduce the time to breaking even on equipment is to strategize carefully about who you’re buying it from. For most pieces, there are multiple companies that make the same kind of product. For example, both John Deere and Caterpillar offer very similar equipment.

Make sure you’re getting the best deal on what you’re buying, so it doesn’t take as long to recoup the expense.

Utilization Rate

Utilization rate is another KPI that you have to track in equipment rental. Maximizing time on rent is a critical path to running an efficient, profitable rental company. .

What it means is this – how much of your inventory is on rent at any given time?

It’s the total number of pieces of equipment in your inventory, divided by the number that are typically rented out at any time.

You want this number to be low. If it’s too high, that means that you have excess inventory.

Utilization rate is incredibly important in the equipment rental business. But it’s especially integral to heavy construction equipment, where downtime is even more costly given the higher price points and dollar value of equipment.

We talk a little more about utilization in detail about this further down. Click here to jump to that section.

Income-to-Maintenance Ratio

Equipment rental businesses have significant maintenance costs. It’s just part of this kind of business. Any kind of equipment – boats, bulldozers, bounce houses, any of it – undergoes regular wear and tear when your customers use it.

The income to maintenance ratio shows whether your revenue can cover your maintenance costs. It’s your income divided by your maintenance costs over any period.

One effective way to offset your maintenance costs is to charge customers extra – in the construction rental space, this is often 10-15% on top of the total – in exchange for a damage waiver.

That extra income can help you build a buffer fund that can cover the cost in a worst case scenario.

Especially for equipment that gets rented out long-term, it’s essential for the customers themselves to perform routine maintenance and keep your equipment in good shape.

If they aren’t doing that, or something goes wrong with a rental for that reason, this ratio can get out of hand fast.

Another way to help mitigate maintenance and repair costs is to make sure you document the condition of each piece of equipment, with photographs, both before and after each rental period.

That way, if they didn’t pay for a damage waiver and they’re at fault for serious damage to your equipment, you have photographic proof that they damaged it – smoothing out the process of sending them the repair bill.

These are the most important for core business operations. Now let’s talk about sales and marketing.

These five are The Big Ones. But there are others as well.

What Are the Top 5 Financial KPIs in Any Rental Business?

Debt to Equity Ratio

The ratio of debt to equity – that is, the total amount of debt that your company has, divided by your total equity – is a key indicator of how much financial leverage you have.

For equipment rental companies, an ideal ratio is generally considered to be around 3% or lower. This, however, is relatively uncommon. Many rental companies report ratios totaling as much as 50-70%.

Realistically, you may want to consider taking action if your debt to equity ratio exceeds around 20% or so. The more aggressive your company is about financing business growth with debt, the more open it becomes to the potential for financial problems.

Aging Accounts Receivable

This KPI refers to the number of accounts that have long payment times, and ideally, this metric should remain as low as possible.

A reliable invoicing solution like Quipli can help you with managing timely invoicing and payments.

You can also implement financial measures to help offset these problems, such as late payment fees, strict terms for financing, a discount for early payments, and other measures to help lower this metric.

Rental Rates & Revenue Generated

This metric assesses the total equipment revenue for a specific time period – often daily – versus the total amount of equipment revenue paid and rented during that time frame.

This helps benchmark results by day, month, quarter, and year.

Financial Utilization

Financial utilization is a very important metric for rental businesses’ finance and accounting departments. You want your equipment out on rent enough to generate adequate revenue to cover its expenses and loan debt.

That said, though, too high a utilization rate can also increase the equipment’s general wear and tear, driving up your maintenance and repair costs.

As an example, if you have a $25,000 piece of equipment that’s bringing in $23,000 per annum, it has a financial utilization rate of 92%.

While rates do vary depending on what kind of equipment you specialize in renting, typical recommended targets for financial utilization are around 65% for national enterprises, and 100% for small local rental businesses.

What Are the Top 5 KPIs for Sales and Marketing in An Equipment Rental Business?

For your core business to succeed, you need to make sure people know about you. You use sales and marketing to achieve that goal.

Your business needs customers in the first place. These KPIs are how you make sure you get them.

Change in Rental Business Value

Is your business worth more now? Take your total assets minus your debts at any point and compare them at different points in time. Has your business been growing consistently?

In the equipment rental industry, one of the biggest things you need to account for is depreciation. This is especially true in the construction rental industry, or any kind of vehicle rental.

Construction equipment, boats, and similar items depreciate quickly over time – just like cars do.

This needs to be accounted for in your financial calculations. The more time passes, the lower the ROI gets.

Equipment Rental Growth

Rental growth is a key sales and marketing KPI for the equipment rental industry.

It’s measured by taking the difference in revenue between this year and last year. Then, you take that number, and divide it by last year’s revenue.

If your business is doing well, you should get a result of at least 10%.

Customer Acquisition Cost

Your customer acquisition cost shows how much you’re paying to get new rental customers.

Any advertising and marketing incurs costs. This also applies to your sales team and your marketing agency.

You need to make sure that your sales and marketing campaigns and strategies are bringing in more money than you’re spending on them.

To calculate CAC, divide your total costs for sales and marketing. Then, divide it by the number of new customers that you’re successfully getting from those channels over a specific period of time. (Like a per month, per quarter, or per annum.)

This will give you your cost per new customer that you’re getting.

How much are you spending to bring in each new customer who rents from you? Are they spending more than you’re paying to get them to rent from you?

Further on, we’re going to talk more about business-to-business construction equipment rentals. This involves different methods of acquiring customers than most business-to-customer rentals, like wedding equipment rentals or kayak rentals.

Click here to find out more about CAC in B2B construction equipment rentals.

Marketing Revenue Attribution

Marketing revenue attribution is the measure of how much of your marketing spend goes to securing which equipment rental sales you’re making..

You can determine this by finding out how each customer found you and dividing the totals by total market spend.

So let’s break this down. Basically, you’re looking at the data from each type or channel you’re using for marketing and sales, and seeing which ones are bringing in the most revenue because they’re leading to most rentals. You’re comparing your spend for each campaign to the revenue it produced.

This makes sure you’re not spending your budget in the wrong places.

Traffic-to-Lead Ratio

So you’ve got marketing campaigns going. People are visiting your website. You’re getting clicks and traffic. That’s great!

But it’s not the whole story. You’re an equipment rental business, not a media company.

Traffic is worthless unless it converts.

You don’t just need people to visit your website. You need them to actually rent something from you.

Take your site’s total traffic, and divide it by the number of actual equipment rental sales that result from them.

This should be a low number. If the number is high, that means that people are visiting your site, but they’re not converting into actual customers.

These KPIs are the key to honing your marketing efforts. Next comes customer satisfaction.

Tracking these KPIs can help you bring in new leads. But what about returning customers?

What Are the Top 5 KPIs for Customer Satisfaction for Equipment Rental?

Customer satisfaction is unbelievably important for equipment rentals.

When you’ve got a customer that needs to rent a piece of equipment, there’s a strong chance that at some point, they’re going to need it again.

You want them to come back to you – not go to a competitor because you didn’t give them a good enough customer experience.

Keeping your customers satisfied means more return business, so keep a close eye on these customer satisfaction KPIs for equipment rental companies:

Customer Lifetime Value

Customer lifetime value refers to how much revenue you expect from each customer. A satisfied customer will come back when they need you again.

Divide your total revenue by your total number of individual customers. (All of them ever, not just the new ones.)

This gives you an average for how much money each customer usually spends with you. Are they coming back repeatedly to rent from you again? Or is it a low number suggesting that most of your customers are a one-and-done?

If you’re renting to businesses, not consumers, then CVC plays an even bigger role.

Social Media Engagement

Social media. It’s been here for 15 years, and it’s not going anywhere. Businesses need a real presence there.

Your social media traffic numbers can indicate how your customers react to your business, and these values are available through any social media platform.

Now, social media engagement is a complex thing. A lot of companies try to measure traffic, or followers, or other stuff that doesn’t matter. These are called “vanity metrics.”

You could have 500,000 followers and get nothing but crickets.

You want people to like your posts, to comment on them, to share them. You want people to actually engage and talk back and forth with your brand, not just hit “Follow” then forget about you.

Satisfied customers tend to add you on social media. And guess what, if those satisfied customers are sharing your posts with their friends, they’re probably going to reach out to you next time they need to rent a piece of equipment.

Net Promoter Score

You can measure this KPI by asking customers how likely they are, on a scale of one to ten, to recommend your business to a friend and average the results.

One way to implement this is by creating a customer satisfaction survey to send to people after they’ve rented from you. (Quipli can help you do that.)

If you’re B2B, you might also consider having one of your sales reps call customers individually, to ask them for feedback about their experience.

Once you have enough of this information to work with, the next step is to analyze it. Compile your findings into a report.

Are customers happy with their rental experience? If not, why not? Are there any common recurring customer complaints or issues?

This information can be extremely valuable in helping your business grow and improve over time. If there’s anything you need to work on or fix, this is a great way to find out about it.

Customer Reviews

You can find customer reviews for your business on multiple platforms, and tracking those scores is a great way to gauge overall satisfaction

All of us have, at one point or another, decided against buying something from a company because they had a lot of bad reviews. The last thing you want is to be that company.

You generally want to make sure your total review score across various platforms – Google searches, online directories, your website – is at least a 4 out of 5.

Customer Churn Rate

This rate is the percentage of your customers who are first-time customers. A lower churn rate indicates more repeat business.

If your churn rate is too high, you might need to change what you’re doing to make sure that people come back again.

With that said, though, the hard reality of the business world is that you’re always going to have churn. You could be the best business in your entire industry, the creme de la creme of equipment rental, and you’d still lose the occasional customer.

You can work to lower your churn rate, but it’s never going to hit zero.

What you can do to offset churn, though, is to set goals for your sales team. Have them bring in a set number of new customers per month or per quarter. You need an influx of new customers to replace those that leave.

Construction Equipment Rental Business KPIs

Construction equipment rental businesses are a distinct and important sector within the equipment rental industry.

So far, we’ve mostly been talking about equipment rental in general. But if you’re renting out backhoes and bulldozers, well, that’s a totally different matter than someone who’s renting out kayaks or party equipment.

If your business rents out heavy construction equipment, this section is for you. This sector comes with its own unique needs, and there are some additional KPIs that you need to be measuring.

A big one is utilization. The more that a given piece of equipment rents out, the more money it makes for you. If it’s just sitting there in your warehouse and no one’s using it, all it’s doing is eating up your money.

Another thing that differs is how you approach customer acquisition cost. Customer lifetime value is much higher with B2B construction equipment rentals than it is for B2C companies.

We’re going to talk about each of these in detail.

Utilization Rate: A Key Factor for Construction Equipment Rental Success

Your utilization rate is basically a measure of how many of your machines are currently on rent, versus how many total you have in your fleet.

You don’t want that number to be too high, with equipment collecting dust in a warehouse instead of out there making money for you. But, you don’t want it to be too low, either.

A good utilization rate to shoot for is 70-80%, with 75% being about ideal for construction rentals.

If your utilization rate is lower than 70%, then you’re not bringing in enough customers relative to how much equipment you have. Solving this could mean bringing in more customers through better sales tactics, or it could even mean selling off equipment that doesn’t have high enough demand to justify its cost.

But if it’s over around 80% or so, that’s also a problem.

Keep in mind that not all of your equipment is just sitting in storage.

Some of it might be under repair. Let’s say 5%, as an example.

Other equipment might be recently off rent, but undergoing routine maintenance before it can be rented out again.

That leaves 15% total that’s out of commission temporarily. This needs to be accounted for.

Too high a utilization rate means that you might not have a piece of equipment on hand when someone calls you asking to rent it. They’re not going to wait, so you essentially have to turn them away.

And the last thing any business wants to do is to turn away paying customers.

New deals can come in fast, especially if you’ve got a good sales team. A 75% utilization rate is perfect for keeping plenty of equipment on rent and making money, while still having enough inventory for the new customers that come in.

Fleet Age

Another KPI that’s relevant for heavy construction equipment rentals is fleet age – the general age of the vehicles in your rental fleet, in comparison to when the units first went into service.

This metric plays into maintenance for used and refurbished construction equipment, as well as for determining the value of your fleet in light of depreciation over time.

Fleet Apportionment

This KPI measures the partitioning of your fleet into a “base fleet,” and then an “other fleet” category.

“Base fleet” should generally refer to equipment that has rental activity across multiple time periods (e.g. weeks, months, quarters, or years). “Other fleet” generally includes changes to your equipment fleet – that is, units that were added, or that were sold off or eliminated.

This can give you meaningful insight into changes in revenue, and can also help you improve utilization data by restricting to your base fleet only.

Customer Acquisition Cost: The Power of a Great Sales Team

When people talk about customer acquisition cost, they’re referring to both marketing and sales. But the type of business you’re running, and the kind of customers you have, makes a big difference in where and how you’re acquiring those customers.

Let’s get real: you’re not landing that $2 million deal because someone saw a Facebook ad, or read a blog post on your website.

At that kind of level, in B2B construction rental, you’re looking at using knowledgeable professional sales representatives to cultivate real relationships with prospects and customers.

Paying a top-tier salesperson salary and commission brings a higher CAC than, say, running some Facebook ads. This cost, however, is well worth it if you have a strategic sales process in place.

Customer Lifetime Value: Building Long Term Customer Relationships

In construction equipment rental, you need to build long term relationships with satisfied customers who keep coming back to you.

For B2B rentals, you’re looking at a much higher CLV than with B2C rentals. You’re building a relationship with another business.

If you lose a customer – due to messing up with a rental, or your equipment failing unexpectedly – that means you’re losing a lot of money.

When you’re working with contracting outfits as a B2B renter, you need to be extremely responsive to customers. Sometimes, if something goes wrong, you’ll lose a lot less money if you take a short-term loss and do something like compensate them or pay to fix the problem.

Losing a customer in this industry is something you absolutely want to avoid.

What Software Tools Should I Use to Manage KPIs?

The most important aspect of implementing KPIs is to track them accurately and reliably.

A good way to do that is to use software that’s specifically designed to manage every aspect of your equipment rental business.

At Quipli, that’s where we come in.

Tracking by hand, juggling multiple apps and spreadsheets, can be exhausting and hard to maintain. Quipli puts everything in one place, from inventory tracking to digital marketing and business growth.

Everything you need for your business to thrive, all in one convenient, easy-to-use app you can access from anywhere.

With Quipli, tracking your KPIs has never been easier.

Touch base with us any time to find out more about what Quipli can do for you.

MANAGE YOUR KPIs WITH QUIPLI’S RENTAL BUSINESS MANAGEMENT SOFTWARE