Rental companies need to determine their total equipment value for various reasons, whether it be for buying and selling equipment, auditing your rental inventory, or getting it insured.

Equipment values will vary based on your business, but our used equipment value calculator is a great first step in creating a construction equipment price guide.

Reasons for Valuation

The reason you’re looking to value your equipment will play a role in which equipment value estimator and approach you’ll use. Are you looking to buy or sell a piece of equipment? Assessing the value for insurance purposes? The valuation methodology you’ll use depends heavily upon the reason you’re trying to determine a value for your equipment in the first place.

When it comes to valuing equipment for buying or selling, there are three key valuation methods.

1. Fair Market Value

Fair market value is a valuation method in which both a buyer and seller are willing to partake in a transaction. Say you’re looking to start a rental business: To get an idea of the costs involved, you can use a fair market value calculator. Equipment you’d need can be entered into the calculator to determine the price you’d pay.

If you already have a rental business but are looking to upgrade your equipment by selling some older items, then the fair market value is likely what you’ll use to get a rough idea of how much you could sell your equipment for.

2. Orderly Liquidation value

The orderly liquidation value is what’s expected when a seller is forced to sell an asset with some time constraints. This method gives a reasonable amount of time to find a willing buyer. This valuation is generally less than the fair market value.

3. Forced Liquidation Value

A forced liquidation value is the asset’s value if sold almost immediately at auction. This valuation assumes the assets or equipment are sold as soon as possible and is generally lower than the orderly liquidation value.

Insurance

If you’re looking to value your equipment for insurance purposes, such as filing an insurance claim or purchasing a new insurance policy, you’ll use one of the three methods below.

1. Actual Cash Value

Insurers may use the actual cash value to determine the value of your equipment. This value is calculated as the replacement cost of the equipment and incurs less depreciation.

2. Replacement Cost New

The new replacement cost is the value of purchasing the latest version of the same piece of equipment, brand-new.

3. Reproduction Cost New

The new reproduction cost is the valuation for a piece of equipment based on the costs involved in reproducing the equipment with the same specifications, based on current prices.

Financial Reporting and Financing

If you’re valuing your equipment for financial reporting or to raise funding for your business, there might be specific requirements. For example, a lender may base its valuation on the market price of the equipment for calculating the loan-to-value ratio.

How to Calculate Your Equipment Value

Regardless of the reason, if you’re looking to calculate the value of your equipment, you’ll need to do the following.

Identify and Compile the Relevant Information for Each Piece of Equipment

To get a proper valuation done, you’ll need to gather key information for each piece of equipment you have, such as:

- Purchase date

- Purchase price

- Accumulated depreciation

Keep a file with this information readily accessible.

Determine the Right Valuation Methods

There are three different methods that are generally used for equipment valuations: the sales comparison approach, the cost approach and the annual straight line depreciation method.

Sales Comparison Approach

The sales comparison approach looks at the current market for new and used equipment — what are the current prices for similar equipment between willing buyers and sellers? A sales comparison approach is used when sales data is readily available.

The age and condition of the property are taken into account when looking at used equipment. This may involve looking at recent auctions, dealer listings, and conversations with vendors to assess the market.

The best way for this approach is to start keeping track of what similar equipment is being sold for so you can gauge your own equipment.

Cost Approach

The cost approach (also known as the cost method) uses the new replacement cost. This method is generally used when there’s not an active market for the equipment. For example, you have a specific type of excavator that the manufacturer no longer sells, and as such, there’s no real market for it. Your heavy equipment valuation calculator should point you toward using the new replacement cost for a new version of a similar piece of equipment.

When there’s not an active enough market for the sales comparison approach, that’s when the cost approach is used. It is also suitable when the product is highly customized.

If you have a rental business that uses custom equipment, the cost approach is what you’d use for your valuations. The cost approach may include reaching out to manufacturers and vendors to appraise the custom equipment needed to reproduce the asset and may also involve checking published price lists.

If the equipment is no longer made, the cost approach may include reaching out to the previous manufacturer to see if they can provide an estimate of what the equipment would cost to build today, factoring in present technology and current prices for supplies.

Calculate the Equipment Value

Now that you’ve nailed down the reasons for your valuation, you should have a general idea of the best method to conduct it. If you’re using the sales comparison approach, look at the buy-and-sell market for new or used equipment like yours. The cost approach means you’ll need to find equipment that’s similar to yours and factor in depreciation.

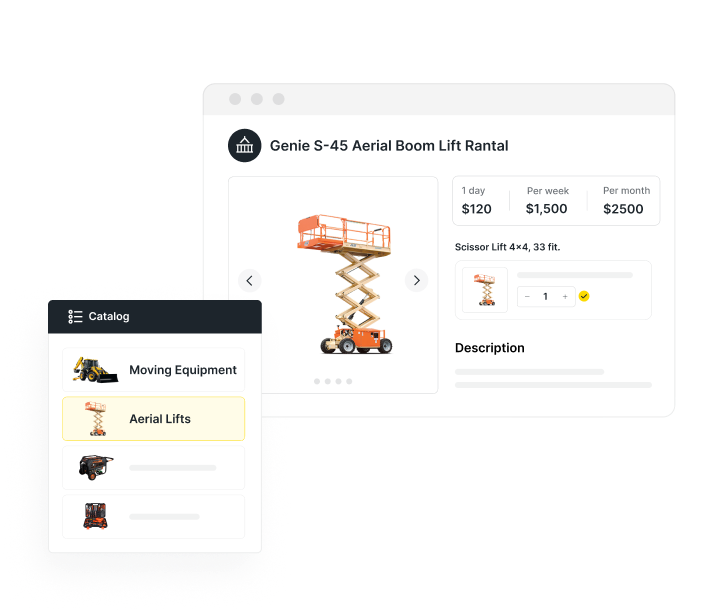

Build Your Quipli Rental Business with Quipli

Quipli is an all-in-one software solution for rental businesses. Our equipment rental software helps rental companies track their inventory to maximize revenue-generating opportunities and integrates with our reservation & scheduling tool for a seamless customer experience. Reach out to the Quipli team today to learn more.

Looking to start leasing out your equipment? Explore our helpful guides on how to start an equipment rental business and leasing pricing strategy.

Learn About Quipli’s rental Software