After starting a rental business and running it for years, you may eventually find yourself thinking about selling it to someone else.

To sell a business, you’ll need to get an accurate determination of how much the business is actually worth. There are several different valuation methods that you can use to do this.

Types of Valuation Methods

Various methods can be used to value a rental business. Three of the most common methods are asset value, future earnings, and comparable sales.

Asset Methodology

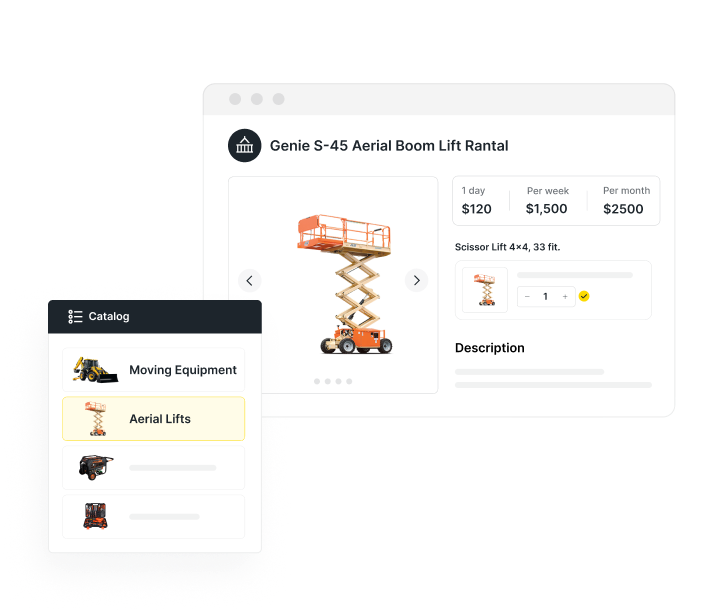

The asset methodology for valuing a rental business uses the value of the equipment you own.

This is the fair market value of all the assets you possess. Thus, you’d find the value of each piece of equipment and add them all up. Each asset’s value can be calculated based on what similar pieces of equipment sell for on used equipment marketplaces.

If a particular asset is no longer on the market, you may have to use another method to value it, such as figuring out what it would take to build your equipment to the current specifications with today’s price. Similarly, if you have a customized asset, you may need to calculate what it would take to add the same customizations in today’s dollars.

Future Earnings Methodology

The future earnings methodology calculates your company’s value based on its current and future earnings. This involves estimating what your business will likely generate in the future and discounting it back using a discount rate.

This method is also known as a “discounted future earnings” valuation, as it requires you to forecast your rental company’s future revenue. After modeling earnings for each period and calculating a terminal value, you discount the amounts back to the present to get the current value.

Comparable Sales Methodology

Comparable sales valuations look at what similar businesses have sold for recently. This generally involves calculating the valuation multiples for past business sales. The ideal multiple will be based on the specific industry.

For example, if your business generates $2.2 million in EBITDA (earnings before interest, taxes, depreciation, and amortization) and the average EBITDA multiple that equipment rental businesses sell for is 8, your valuation would be roughly $17.6 million.

While the EBITDA multiple is widely used, you may also see other multiples applied, such as an earnings multiple, sales multiple, or EBIT (earnings before interest and taxes) multiple. Some comparable sales methodology valuations may include an average of various multiples.

Factors Impacting Your Valuation

Many factors can come into play when valuing your equipment rental business. Most of these are things you might expect, like revenues and profit margins, but there are others worth highlighting.

Amount of Sales

To start, you’ll need to know the estimated amount of sales you’ve had — specifically, your average annual sales figure. Generally, the higher the sales, the better.

Total Profit

Total profit is another figure you’ll need to arrive at an accurate rental business valuation. This is the average annual net profit for your business. Once again, the higher, the better.

Recent Growth Trends and Future Growth Projections

The continued growth of your sales and profits will also play a key role. Is your business slowing down, or have sales and profits been steadily on the rise? Is your business expected to keep growing with new sales channels or partnerships? These are all questions worth knowing the answers to.

Growth in the Number of Sales (and the Origin of That Growth)

If your revenue is on the rise, where is the surge coming from? Maybe you’ve been more effective with marketing, or perhaps the sales growth was short-lived. Prospective buyers will want to know what’s behind your growth and whether it’s sustainable.

Market Positioning

Where are you regarding market share for your industry? If you’re the market leader, do consider whether you have any competitive advantages that will let you keep that position. If not, look for opportunities to claim more market share.

Geographic Location

When it comes to the location you serve, it’s wise to determine whether you have opportunities to expand your current geographic footprint. Being located in a fast-growth area for the equipment you offer can be a great advantage.

Systems and Processes in Place for Running the Business

Lastly, think about how involved you are with your business. Do you have systems in place that let your business run efficiently without a lot of labor hours? You might have opportunities to automate parts of your business, such as inventory or rental management, for superior efficiency.

Selling Your Equipment Rental Business

When it comes to selling your rental business, you have several options.

Business Brokers

Business brokers are great if your company generates $1 million or less in annual revenue. Business brokers specializing in the rental industry can be found on various online marketplaces.

Merger and Acquisition Advisors

Merger and acquisition (M&A) advisors are suitable for businesses with revenues between $1 and $50 million. A good M&A advisor will help you find buyers, negotiate terms, and structure a favorable deal.

Investment Banks

Investment banks are ideal for larger businesses, especially those with more than $50 million in annual revenue. Investment banks specialize in tracking down big buyers and handling the terms of the deal.

Interested in Leasing your rental equipment? Explore our guide on equipment rental leasing pricing strategy today!

Are You Ready to Sell Your Business?

If you have a rental business but are considering breaking into a different industry, you’ll first need to figure out what your business is worth. This is true if you need a business appraisal as well. A precise valuation will ensure you get the correct amount for your niche business.

These well-protected businesses sell well and often, making it easy to find an estimated value for your company. A qualified broker or advisor can help you figure out your valuation and connect you with prospective buyers offering what your business is worth.

There are also a few simple steps you can take to help boost your valuation. A great place to start is to make sure you have as many tasks automated as possible, including your rental and inventory management processes.

Learn About Quipli’s rental Software